Book Review: “Die With Zero”

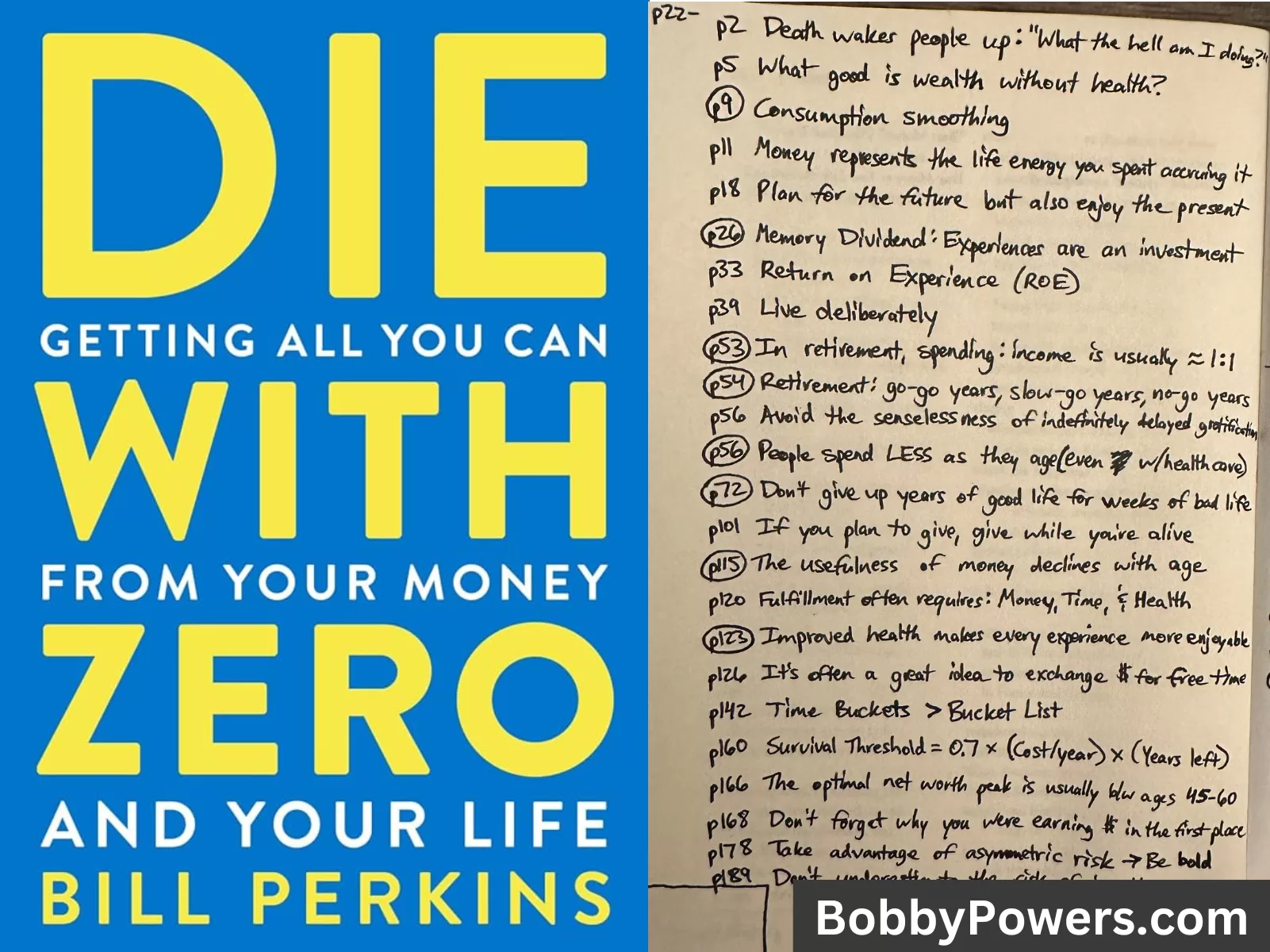

I write in the back cover of every book I read, as shown above.

To learn more about my book notes system, click here.

Book: Die With Zero by Bill Perkins

Reviewer: Bobby Powers

My Thoughts: 10 of 10

Die With Zero is one of the most practical yet countercultural books I've ever read. It's the personal finance book I didn't realize I needed. For years, I've read about the power of compounding interest and the importance of saving while you're young. Perkins agrees with those concepts (he is a hedge fund manager, after all), but he also poses some fascinating questions on the other side: What happens if you save a bunch of money but die early? Or what if you aren't healthy enough later in life to gallivant around and spend the money you've hoarded? In short, what if you're saving too much?

I loved this book because it flies in the face of most personal finance advice, yet I found myself nodding along as I read the core principles of every chapter. Perkins tells emotional stories, brings relevant data, and logically explains each point. By the end of the book, I was so convinced by his arguments that I immediately made a couple of big financial changes in my life.

What I Learned from the Book

People fall into one of two broad camps for their financial situation:

- Those who are saving too little -> aka The majority of people

- Those who are saving too much.

I didn't realize the second camp existed until I read this book. Die With Zero is written for that second camp of people.

If you're a middle- to high-income individual who has been focused on socking money away into your 401(k), IRA, and investment accounts, this book will help you make sure you're not minimizing your life while you're maximizing your money.

There's an optimal amount of savings for each person, and it's based on a slew of factors: your current income, your future income, your health, etc. And contrary to popular opinion, it's actually possible to save TOO MUCH. Perkins unpacks why in this book.

"Life is not a game of Space Invaders—you don't get points for all the money you rack up in the game—but many people treat it as though it were. They just keep earning and earning, trying to maximize their wealth without giving nearly as much thought to maximizing what they get out of that wealth—including what they can give to their children, their friends, and the larger society now, instead of waiting until they die." -Bill Perkins

Note: This book review is not intended to serve as investment advice. If you're thinking about changing your personal finances, consult a licensed financial advisor, not me or Bill Perkins. 😉

Selected Quotes & Ideas from the Book

Maximizing Fulfillment, Not Dollars

- "This book is not about making your money grow—it's about making your life grow."

- "Just to be up front: If you're struggling to make ends meet, you might get some value out of this book, but not nearly as much as someone with enough money, health, and free time to make real choices about how to put those resources to the greatest use."

- "Life energy is all the hours that you're alive to do things—and whenever you work, you spend some of that finite life energy. So any amount of money you've earned through your work represents that amount of life energy you spent earning that money. That is true regardless of how much or how little your work pays. So even if you're earning only $8 an hour, spending that $8 also means spending an hour's worth of your life energy." (Concept from Your Money or Your Life by Robins & Dominguez)

- "My overarching goal is to get you to think about your life in a more purposeful, deliberate manner, instead of simply doing things as you and others have always done them. Yes, I want you to plan for your future—but never in such a way that you forget to enjoy the present."

Wealth + Health

- Wealth doesn't matter much without health. You need to be healthy enough to spend your money on things you enjoy (travel, entertainment, meeting up with friends, etc.).

- "In other words, to get the most out of your time and money, timing matters. So to increase your overall lifetime fulfillment, it's important to have each experience at the right age."

- Retirement planning experts use the following terms for retirees:

- Go-Go Years = (60s-ish) You're still young and able to have fun experiences

- Slow-Go Years = (70s-ish) You're starting to slow down and your health is potentially declining

- No-Go Years = (80s and beyond) Regardless of how much money you have, you're not going out much

- "The utility, or usefulness, of money declines with age."

Spending Wisely

- Consumption Smoothing = Spending money in proportion to how much you will be earning now AND later, rather than just how much you're making now

- "Our incomes might vary from one month or one year to another, but that doesn't mean our spending should reflect those variations—we would be better off if we evened out those variations. To do that, we need to basically transfer money from years of abundance into the leaner years. That's one use of savings accounts."

- Example #1: If you're making $200K/year as a lawyer right now but you hate the law and you're planning to hang up your suit to become a barista, consumption smoothing would mean spending WAY less than your current income to prepare for what you'll be making soon.

- Example #2: If you're in medical school and not making much, consumption smoothing would mean spending MORE than your current income because you know you'll be making a higher salary soon.

- "It's crazy to save 20 percent of your income when you're young and have good reason to expect to earn much more in the next few years. In fact...it can even make sense to borrow money (spending more than you're currently earning) when you expect to earn a lot more down the road...I'm not saying you should be racking up credit card debt—such high-interest loans are a bad idea for almost everyone. Borrow modestly and responsibly."

- If you're worried about outliving your money: You can invest in things like annuities. "Annuities are essentially the opposite of life insurance: When you buy life insurance, you're spending money to protect your survivors against the risk that you'll die too young, whereas buying annuities protects you against the risk of dying too old (outliving your savings)."

- If you're worried about having big medical expenses later in life: "Remember that you can buy long-term care insurance, which costs far less than self-insuring by saving massive amounts of money for a crisis that may never come."

Invest in Experiences

- "Many psychological studies have shown that spending money on experiences makes us happier than spending money on things. Unlike material possessions, which seem exciting at the beginning but then often depreciate quickly, experiences actually gain in value over time: They pay what I call a memory dividend."

- "Think back to one of the best vacations you ever had, and let's say it lasted a full week. Now think about how much time you spent showing pictures of that trip to your friends back home. Add to that all the times you and the people you traveled with reminisced about that trip, and all the times you've thought about it yourself or given advice to other people considering going on a similar trip."

- "All those residual experiences from the original experience are the dividends I'm talking about—they're your memory dividends, and they add up. In fact, some of these memories, upon repeat reflection, may actually bring more enjoyment than the original experience itself."

- "So buying an experience doesn't just buy you the experience itself—it also buys you the sum of all the dividends that experience will bring for the rest of your life."

- "The business of life is the acquisition of memories. In the end that's all there is." -Carson on Downtown Abbey

- "I realized that you retire on your memories. When you're too frail to do much of anything else, you can still look back on the life you've lived and experience immense pride, joy, and the bittersweet feeling of nostalgia."

- "Once you start thinking about the memory dividend, something becomes really clear: It pays to invest early...It's kind of like what Warren Buffett says: Invest early, and by the time you get to a certain age, look at how much you've accumulated."

- "Warren Buffett and other investment advisers are trying to grow money, and I'm trying to grow the richest life I can; and when I say rich, I mean rich in experiences, in adventures, in memories—rich in all the reasons you acquire money."

- "So here's my investment advice in a nutshell: Invest in your life's experiences—and start early, start early, start early."

- "The last thing I want for you is to finish rich in money and poor in enjoyable experiences."

Retirement Spending

- "Research on people's actual retirement spending shows that spending isn't constant, and often declines in later years."

- The Consumer Expenditure Survey "found that in 2017, average annual spending for households headed by 55-to-64-year-olds was $65,000; average spending fell to $55,000 for those between 65 and 74; and spending fell again to $42,000 for those 75 and older."

- "This overall decline occurred despite a rise in healthcare expenses, because most other expenses, such as clothing and entertainment, were much lower."

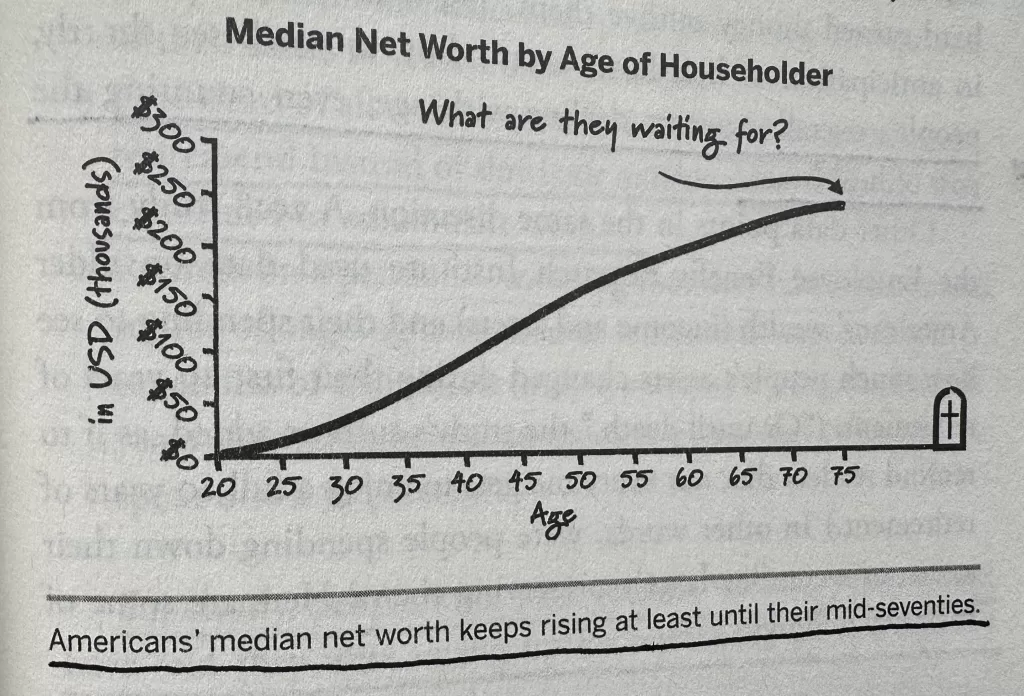

- "How do I know that people save too much for too late? I've seen the statistics. If you look at data on net worth by age, you find that most people keep accumulating wealth for decades, and most don't start spending it down until very late in life."

- "The median net worth continues to rise as people get older. It's easy to guess why—people's annual incomes tend to rise with age, and people continue to save what they don't spend, so their nest egg keeps growing. And that's great to a point, because there is a sweet spot in everyone's lifetime during which they can most enjoy the fruits of their wealth. The problem is that people continue to save well past that optimal point."

- "The median net worth for American householders aged 75 or older is the highest of all the age groups: $264,800. So even with rising life expectancies, millions of Americans are on track to have their hard-earned money outlive them. Yes, older people often save in anticipation of healthcare costs—but...people's overall expenses decline with age, even counting the cost of healthcare."

- "Across ages, whether looking at retirees in their sixties or those in their nineties, the mean ratio of household spending to household income hovers around 1:1. This means that people's spending continues to closely track their income—so as people's incomes decline, their spending does too. This is another way of seeing that retirees aren't really drawing down all the money they've saved up."

What About the Kids?

- "Yes, you can certainly leave money to the people and causes you care about—but the truth is that those people and causes would be better off getting your wealth sooner rather than later. Why wait until after you die?"

- If you really think about it, it's a bit selfish to wait to give away your money (to your kids, charity, etc.) until after you die because that's essentially giving away the dregs: whatever you happened to not spend. It's much more thoughtful and selfless to strategically plan what you want to give away, when, and to whom—then give those funds to people while you're still living.

- "Putting your kids first means you give to them much earlier, and you make a deliberate plan to make sure that what you have for your children reaches them when it will make the most impact. A real plan for dying with zero includes the kids, if you have kids. That way, you've already separated out their money (which becomes untouchable by you) from your money, which is what you must spend down to zero."

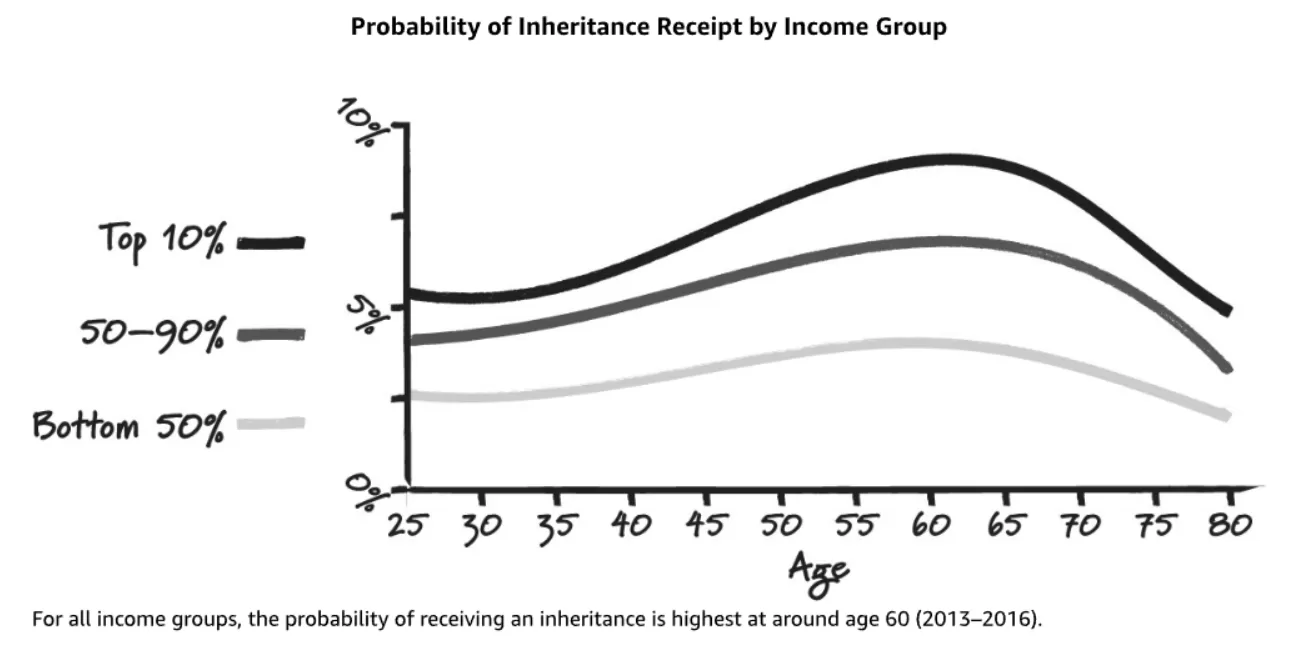

- The average age of death in the U.S. is around 80. If someone has kids when they're 25 and dies at age 80, their kids will receive the inheritance when they're 55. But by that point in their life, the money can't help them out to the same extent it could have earlier—back when they were trying to buy their first home, having their own kids, trying to see the world with family and friends, etc.

- "As your adult children age, every dollar you give them goes less far, and at some point that money becomes almost useless to them."

Trading Money for Time

- "The other big opportunity I see for creating a more balanced life is to exchange money for free time—a tactic that usually has the most impact in one's middle years, when you have more money than time. The classic example is laundry, a time-consuming weekly chore that most people dread doing and that, in many places, can be done inexpensively by an outside service that specializes in it."

- "The more money you have, the more you should be using this tactic, because your time is a lot more scarce and finite than your cash."

- "Research in psychology backs me up: People who spend money on time-saving purchases experience greater life satisfaction, regardless of their income. In other words, you don't have to be rich to enjoy the benefits of spending money to free up time."

- "If you pay to get out of doing tasks you don't enjoy, you are simultaneously reducing the number of negative life experiences and increasing the number of positive life experiences (for which you now have more time). How can that not make you happier with your life?"

Start to Time-Bucket Your Life

- "Time buckets are a simple tool for discovering what you want your life to look like in broad strokes. Here's what I suggest you do. Draw a timeline of your life from now to the grave, then divide it into intervals of five or ten years. Each of those intervals—say, from age 30 to 40, or from 70 to 75—is a time bucket, which is just a random grouping of years. Then think about what key experiences—activities or events—you definitely want to have during your lifetime."

- "Then, once you have your list of items, start to drop each of your hoped-for pursuits into the specific buckets, based on when you'd ideally have each experience."

- "In general, using the time-buckets approach will make you begin to realize that some experiences are better done at certain ages."

- "And just to clarify: This list is a the opposite of the so-called bucket list, which is typically a single accounting of all the things you hope to do before you 'kick the bucket,' so to speak. The more traditional bucket list is usually put together by an older individual who, when confronted with their mortality, begins to scratch out a list of activities and pursuits they not only haven't done yet but now feel compelled to do quickly, before time runs out."

- "By contrast, by dividing goals into time buckets, you are taking a much more proactive approach to your life."

Note: This book review is not intended to serve as investment advice. If you're thinking about changing your personal finances, consult a licensed financial advisor, not me or Bill Perkins. 😉

Think you’d like this book?

Other books you may enjoy:

Other notable books by the author:

- (None)