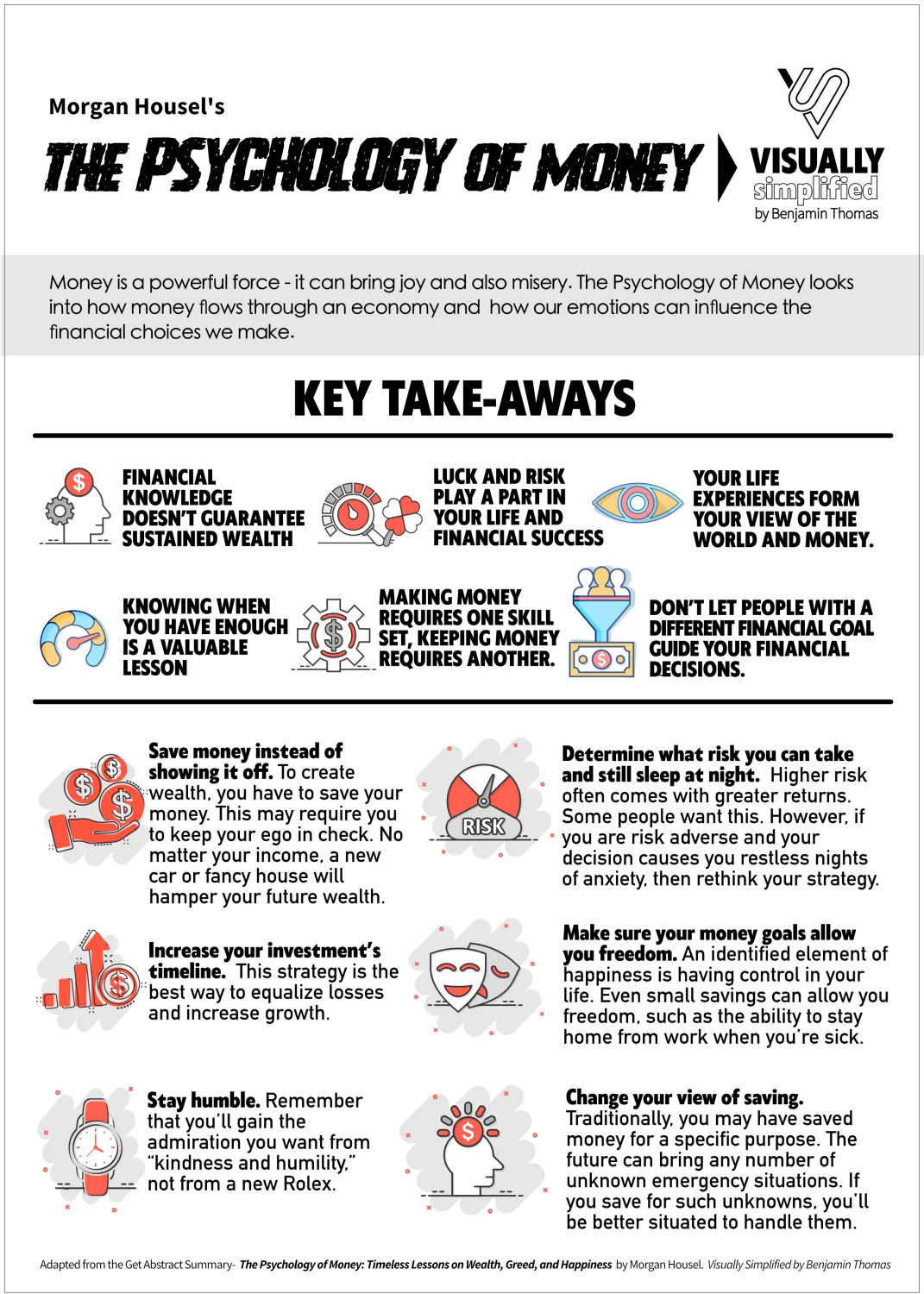

Book Summary: “The Psychology of Money”

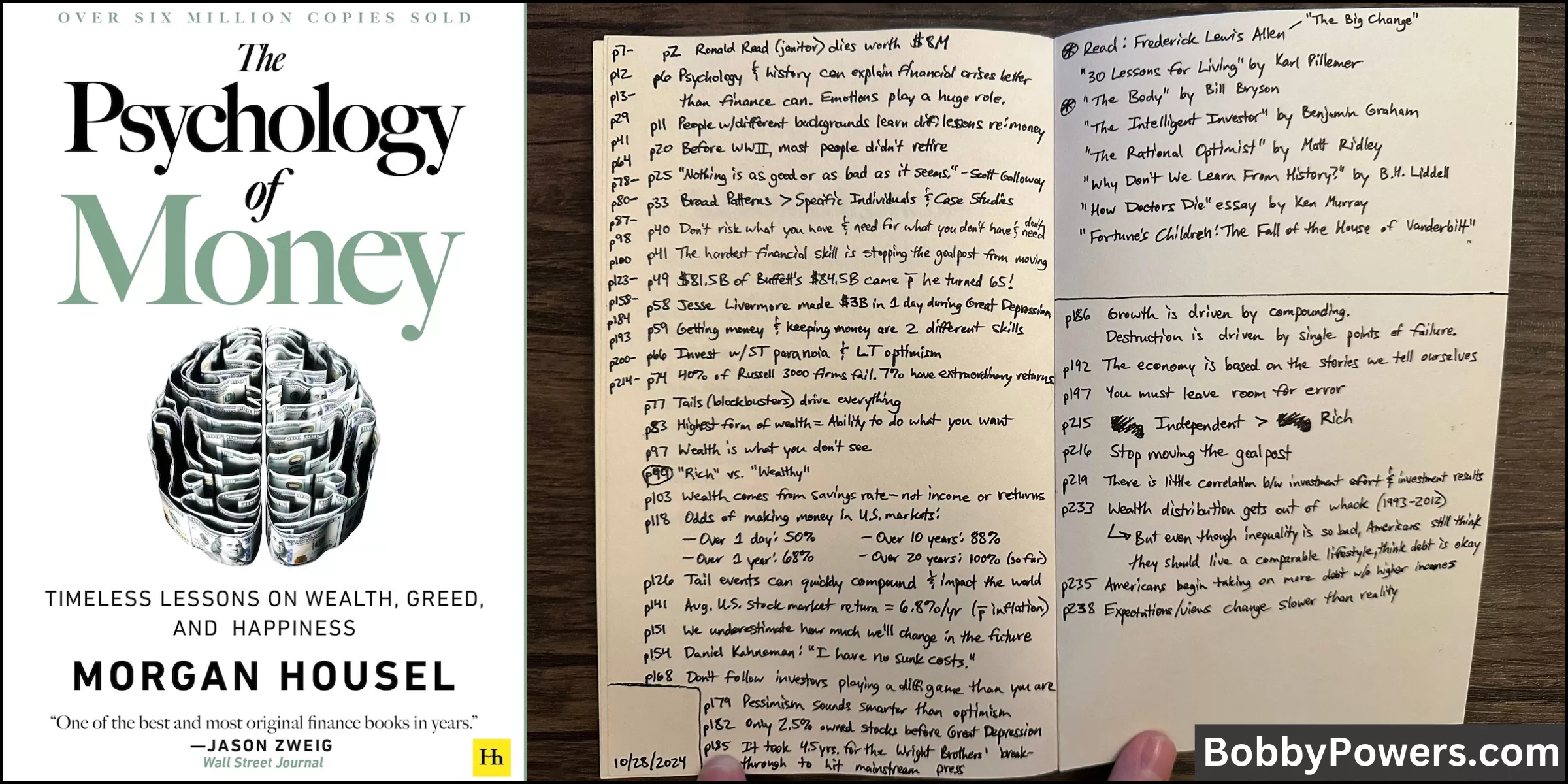

I write in the back cover of every book I read, as shown above.

To learn more about my book notes system, click here.

Book: The Psychology of Money by Morgan Housel

Reviewer: Bobby Powers

My Thoughts: 9 of 10

Damn, what a great book! Rather than focusing on complex equations and esoteric investment advice, Housel offers practical tips and stories about the benefit of saving, the power of compound interest, and the perils of greed. The book lives up to its name—delving into the psychological aspects of money and what causes people to pursue wealth in all the wrong ways. American students would be more financially literate if high school teachers and college professors assigned this as required reading in finance and economics classes.

What I Learned from the Book

Three takeaways really stick with me:

- The best predictor of financial wealth is your savings rate—not your income or investment returns.

- Financial wealth isn't how much money is in your bank account. It's the extent to which you can do what you want when you want.

- People often think they can show off their wealth by purchasing expensive things. But if you see someone buy a million-dollar house, the only thing you know about them is that they're a million dollars poorer than they were yesterday.

"The premise of this book is that doing well with money has little to do with how smart you are and a lot to do with how you behave...A genius who loses control of their emotions can be a financial disaster. The opposite is also true. Ordinary folks with no financial education can be wealthy if they have a handful of behavioral skills that have nothing to do with formal measures of intelligence."

Selected Quotes & Ideas from the Book

The Psychology of Money

- "Financial success is not a hard science. It's a soft skill, where how you behave is more important than what you know. I call this soft skill the psychology of money."

- "We think about and are taught about money in ways that are too much like physics (with rules and laws) and not enough like psychology (with emotions and nuance)."

- "The more I studied and wrote about the financial crisis, the more I realized that you could understand it better through the lenses of psychology and history, not finance. To grasp why people bury themselves in debt you don't need to study interest rates; you need to study the history of green, insecurity, and optimism. To get why investors sell out at the bottom of a bear market you don't need to study the math of expected future returns; you need to think about the agony of looking at your family and wondering if your investments are imperiling their future."

Everyone's Experience Is Different

- "Your personal experiences with money make up maybe 0.00000001% of what's happened in the world, but maybe 80% of how you think the world works."

- "People from different generations, raised by different parents who earned different incomes and held different values, in different parts of the world, born into different economies, experiencing different job markets with different incentives and different degrees of luck, learn very different lessons. Everyone has their own unique experience with how the world works. And what you've experienced is more compelling than what you learn second-hand."

- "The person who grew up when inflation was high experienced something the person who grew up with stable prices never had to."

- "If you were born in 1970, the S&P 500 increased almost 10-fold, adjusted for inflation, during your teens and 20s. That's an amazing return. If you were born in 1950, the market went literally nowhere in your teens and 20s adjusted for inflation. Two groups of people, separated by chance of their birth year, go through life with a completely different view on how the stock market works..."

- "Some lessons have to be experienced before they can be understood." -Michael Batnick

Avoid Greed

- "The hardest financial skill is getting the goalpost to stop moving. But it's one of the most important. If expectations rise with results there is no logic in striving for more because you'll feel the same after putting in extra effort."

- "Modern capitalism is a pro at two things: generating wealth and generating envy."

- "You might think you want an expensive car, a fancy watch, and a huge house. But I'm telling you, you don't. What you want is respect and admiration from other people, and you think having expensive stuff will bring it. It almost never does—especially from the people you want to respect and admire you."

Compound Interest

- "If something compounds—if a little growth serves as the fuel for future growth—a small starting base can lead to results so extraordinary they seem to defy logic."

- "More than 2,000 books are dedicated to how Warren Buffett built his fortune. Many of them are wonderful. But few pay enough attention to the simplest fact: Buffett's fortune isn't due to just being a good investor, but being a good investor since he was literally a child."

- "As I write this Warren Buffett's net worth is $84.5 billion. Of that, $84.2 billion was accumulated after his 50th birthday. $81.5 billion came after he qualified for Social Security, in his mid-60s."

- "Had he started investing in his 30s and retired in his 60s, few people would have ever heard of him."

- "The point is that what seem like small changes in growth assumptions can lead to ridiculous, impractical numbers."

Saving and Investing

- "Building wealth has little to do with your income or investment returns, and lots to do with your savings rate."

- "Savings can be created by spending less. You can spend less if you desire less. And you will desire less if you care less about what others think of you."

- "The historical odds of making money in U.S. markets are 50/50 over one-day periods, 68% in one-year periods, 88% in 10-year periods, and (so far) 100% in 20-year periods."

- But remember: "Things that have never happened before happen all the time." -Scott Sagan (Stanford professor)

- "History is mostly the study of surprising events. But it is often used by investors and economists as an unassailable guide to the future."

Common Sense and Keeping Your Head

- "A genius is the man who can do the average thing when everyone else around him is losing his mind." -Napoleon

- "Good investing is not necessarily about making good decisions. It's about consistently not screwing up."

- "There are a million ways to get wealthy, and plenty of books on how to do so. But there's only one way to stay wealthy: some combination of frugality and paranoia."

- "If I had to summarize money success in a single word it would be 'survival.'"

- "Getting money requires taking risks, being optimistic, and putting yourself out there. But keeping money requires the opposite of taking risk."

- "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." -George Soros

True Wealth

- "The highest form of wealth is the ability to wake up every morning and say, 'I can do whatever I want today.'"

- "The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays."

- "In his book 30 Lessons for Living, gerontologist Karl Pillemer interviewed a thousand elderly Americans looking for the most important lessons they learned from decades of life experience. He wrote:

- No one—not a single person out of a thousand—said that to be happy you should try to work as hard as you can to make money to buy the things you want.

- No one—not a single person—said it's important to be at least as wealthy as the people around you, and if you have more than they do it's real success.

- No one—not a single person—said you should choose your work based on your desired future earning power."

- "Wealth is what you don't see. Spending money to show people how much money you have is the fastest way to have less money."

- "Someone driving a $100,000 car might be wealthy. But the only data point you have about their wealth is that they have $100,000 less than they did before they bought the car (or $100,000 more in debt). That's all you know about them."

- "The only way to be wealthy is to not spend the money that you do have. It's not just the only way to accumulate wealth; it's the very definition of wealth."

- "The world is filled with people who look modest but are actually wealthy and people who look rich who live at the razor's edge of insolvency. Keep this in mind when quickly judging others' success and setting your own goals."